Depreciation calculator for refrigerator

When selling an old fridge its essential to determine the value of your used refrigerator. Appliances - Major - Refrigerator Depreciation Rate.

Depreciation Methods Accounting In Focus

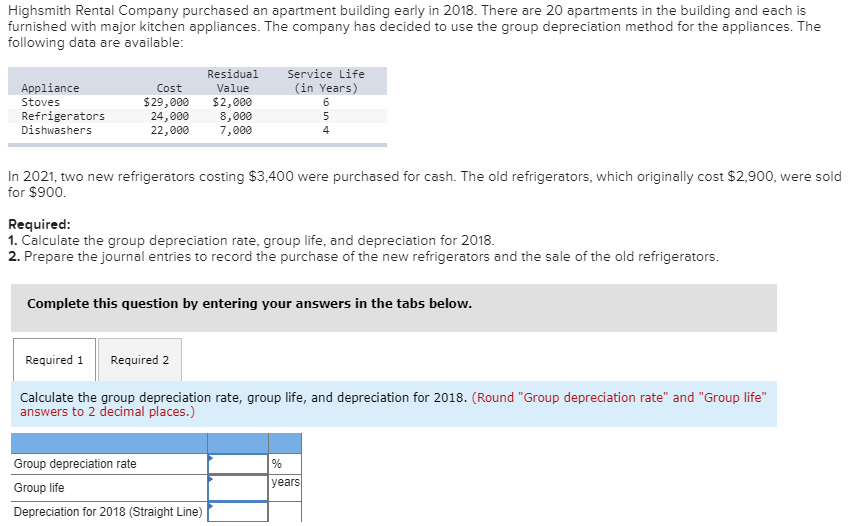

The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below.

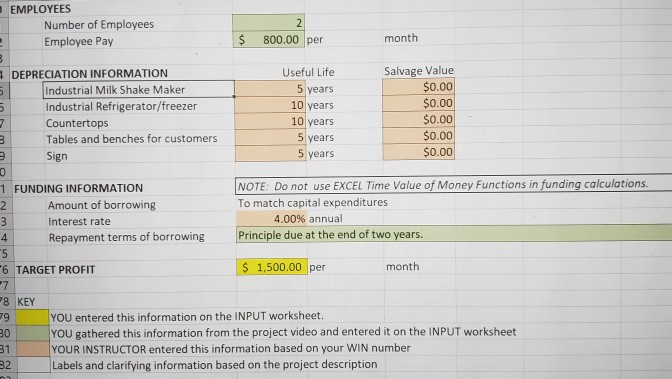

. When adding an appliance to a rental and depreciating using 200 DB switching to SL Half year conventional with recovery period 5. The straight line calculation as the name suggests is a straight line drop in asset value. For example if you have an asset.

Appliance Depreciation calculator makes it easy for you to how to calculate your actual cost value. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Appliance Depreciation Formula.

Looking at the depreciation table in Publication 946 the rate shows as 1819 for an asset placed into service in the 4th month which would give you 2547 in depreciation. Percentage Declining Balance Depreciation Calculator. The appliance depreciation calculator estimates the actual cash value of any home appliances that you own.

CV RCV. Where Di is the depreciation in year i. Uses mid month convention and straight-line.

C is the original purchase price or basis of an asset. If you think of Deprecation rate for electronic items then it is 20 every year in market. Answer 1 of 6.

This depreciation calculator will determine the actual cash value of your Refrigerator - Compact using a replacement value and a 8-year lifespan which equates to 008 annual depreciation. Whether you are thinking about replacing your old appliances. Periodic straight line depreciation Asset cost - Salvage value Useful life.

Depreciation calculator for Refrigerator under the category of Appliances - Major for use in insurance claims adjusting. For instance a widget-making machine is said to depreciate. Assessing its age model and condition will determine the price.

The most common is called the double-declining balance. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. The following formula is used to calculate the current value of an appliance that has depreciated over a certain number of years.

The MACRS Depreciation Calculator uses the following basic formula. It can reduce further if there is any repair happened in compressor. Rental Appliance Depreciation Calculation.

A few different methods can be used to calculate appliance depreciation in rental properties. D i C R i. The depreciation of an asset is spread evenly across the life.

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

The Value Of A Refrigerator Depreciates Every Year The Value Of The Refrigerator At The End Of The Year Is 4 5ths Its Value At The Beginning If At The Beginning Of Year

Solved E Milk Shake Selling Price F G S Small Large D Chegg Com

1

Solved Required 2 Journal Entry Worksheet 1 Record The Chegg Com

1

1

1

Calculate Resale Value Exchange Value For Used Mobile Car Bus Van Laptop Tablet Computer Desktop Furniture Gold And Silver Mixer Grinder Washing Machine Ac Tv Refrigerator And Oven Etc

Depreciation Formula Calculate Depreciation Expense

The Value Of A Refrigerator Depreciates Every Year The Value Of The Refrigerator At The End Of The Year Is 4 5ths Its Value At The Beginning If At The Beginning Of Year

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Accounting In Focus

Depreciation Formula Calculate Depreciation Expense

2021 Section 179 Deduction Tax Incentive Purple Platypus

Depreciation Formula Calculate Depreciation Expense

The Value Of A Refrigerator Depreciates Every Year The Value Of The Refrigerator At The End Of The Year Is 4 5ths Its Value At The Beginning If At The Beginning Of Year

Depreciation Formula Calculate Depreciation Expense